Why VC funding led to major inefficiencies within e-commerce

Playing politics with investors

My opinion then…

Who are the good guys in finance? In 2019, I found myself asking this question. Tennis was on the back burner after a disappointing six months on tour, our startup was flat and not generating the returns we’d hoped, so I was thinking of trying something new. Surrounded by finance aficionados at university and friends transitioning into roles at banks, the stars seemed to be leading me due north in the same direction as my peers.

However, as a naive and under-qualified 23-year-old, I had only stereotypes to gauge what a career at the banks would look like. I didn’t mind long hours, but let’s just say there’s a reason I’m writing here and not building models in Excel. After speaking to a few people willing to offer advice, they all suggested I look into the venture capital space, leveraging some of my startup experience. Moreover, I was excited by the idea of working in an environment where I could collaborate with and learn from founders, helping them turn their dreams into game-changing disruptors.

Today, my general opinion of the VC space is very different. But it’s what I’ve seen along the way that’s led me on a different career path and conclusion.

The challenges of scaling in e-commerce

Many of the challenges involved in raising capital and navigating the politics of founder-investor dynamics are fairly predictable. Unlike software, scaling a direct-to-consumer business comes with numerous variables that make it significantly more complex. Venture capitalists, in their rush to flip an asset before the sector cools, often fail to account for these intricacies during due diligence.

Fixed Costs

In a D2C business, scaling brings a significant increase in fixed cost-to-revenue ratios. Unlike software, where marginal costs remain low, expenses such as inventory, warehousing, insurance, and utilities scale alongside customer acquisition. This makes it harder for D2C brands to maintain profitability as they grow, creating a unique challenge that VCs often underestimate.

CPA Inefficiency

Customer acquisition costs (CPA) have a natural limit to efficiency. Once you surpass a certain threshold of ‘profitable’ customer acquisition, CPA begins to rise sharply. For D2C brands heavily reliant on advertising, this becomes a major hurdle. Venture capitalists, focused on aggressive top-line growth, push founders to spend beyond these efficiency thresholds. This emphasis on rapid scaling can overshadow the importance of organic growth and lifetime value (LTV), creating long-term sustainability issues.

Inventory Risk

Inventory management poses unique risks in D2C. Under cash-based accounting, inventory purchases are recorded as immediate expenses, reducing earnings. Accrual accounting, however, records inventory costs only when the product is sold, treating unsold goods as assets on the balance sheet. As a brand scales, these assets grow, but so does the risk of being stuck with unsellable product if funding dries up. This leaves founders grappling with mounting warehousing costs and unsold inventory, problems that can cripple a business without adequate financial runway.

By understanding these nuances, founders can better anticipate the pitfalls of scaling D2C businesses and navigate the pressures of venture-backed growth more strategically.

Growing too fast and the affect on lifetime-value

What do I mean by growing too quickly? If you’re venture-backed, you’re likely under pressure to prioritize achieving a high revenue valuation over focusing on the business's bottom line. This often means aggressively spending on advertising to hit a target CPA, with increasing revenue as the ultimate goal. For bootstrapped businesses, having low acquisition costs can be a compelling metric to present to VCs when the time comes to scale. However, if you’re venture-backed from the start, you’re often relying on projections and assumptions rather than real data to guide those decisions.

This creates a major challenge: by focusing too heavily on revenue at the expense of profit, you risk undermining the long-term potential of your business. There’s only so much funding you can raise before investors demand improved efficiency and a clear path to profitability - whether that’s in your first series or your last. For operators, understanding customer lifetime value (LTV) is crucial. However, most brands require 12-24 months of solid data to measure LTV accurately.

For example, in fashion, a customer who has a positive experience is likely to make multiple purchases - perhaps 2, 3, or even 4 or more. If the average order value is $100 and you acquire a customer at break-even on their first purchase, you can anticipate organic returns that contribute an additional $300 to $400 in revenue. However, this process may span an entire season, requiring patience to evaluate the customer’s full purchasing journey.

Now consider a bike brand. How often does someone buy a second bike? Rarely. This means you must be profitable on the first purchase, as the LTV is much closer to 1 than 4 purchase cycles. In such cases, building strong brand equity becomes critical for maximizing long-term value. Unfortunately, investors often ignore the need for patience, instead pushing for aggressive revenue growth in the first year. They may even sell secondary shares to another buyer, betting on a revenue-based model rather than the brand's actual potential.

Sitting on cash is more valuable to investors when the going gets tough

One of the biggest challenges facing roll-ups and struggling D2C brands today is the impact of rising interest rates and a pullback from limited partners (LPs). With interest rates spiking, many investors are reducing or withdrawing capital commitments outlined in term sheets. For example, as a founder, you might need 10,000 active customers to reach profitability. But if your investor pulls funding to minimize their losses, you’re left with a growing business and no capital to scale further. Investors can write off the investment as a loss and sit on their cash, especially with interest rates hovering around 5%.

This leaves you with an inefficiently scaled business burdened by high fixed costs and no resources to move remaining assets off your balance sheet. In this scenario, your equity could become worthless. Brands that have a strong understanding of their customer LTV and can drive recurring organic sales are far better positioned for sustainable growth. By increasing the share of sales generated from organic traffic rather than paid acquisition, you not only gain deeper insights into your customer base but also create a foundation for scaling within sustainable limits.

My opinion today about the venture space

There are significant benefits to raising capital. Venture capital has undeniably brought businesses to life that would have had no chance without funding. As a founder, you gain the opportunity to run a business on someone else’s dime, with relatively low personal liability. However, clashes between investors and founders over operational expenses are almost inevitable. Decisions such as which agencies to hire, the size of the team, where to invest, and how to manage the brand often create friction.

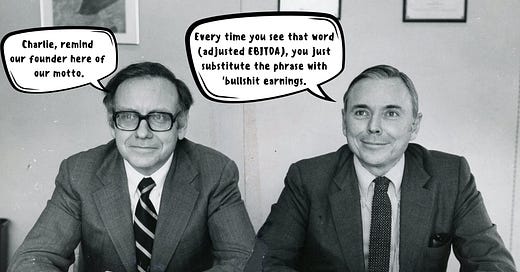

Many investors, especially those from larger firms, lack a deep understanding of your business and customers. They often assume that simply spending more will lead to better results - a misguided mindset. This short-sighted approach is one reason why many D2C brands struggle to turn a profit. The push for quick returns, particularly when the goal is to go public, continues to drive short-term valuations in e-commerce, influencing investor behavior in ways that aren’t always beneficial for the brand.

We’re seeing similar patterns today with AI. While the S&P has surged 30%+ over the last year, only two publicly traded AI companies are actually profitable (NVIDIA and Palantir). The dominance of blue-chip companies driving this rally has created a misleading narrative that many companies are thriving when, in reality, they’re not. Valuations for AI-driven businesses are skyrocketing, yet very few are generating profits. Meanwhile, almost all public D2C brands remain down 80% or more since their IPOs.

I’m often asked about my views on the VC space in e-commerce. I have immense admiration for founders who have bootstrapped successful businesses, but I also recognize how difficult that is for most people today. While I remain pro-VC, I’m critical of how many venture capital firms operate. When a brand scales inefficiently, someone in the pipeline almost always ends up losing, and it’s often due to investor greed (for lack of a better term). Because of this, founders sometimes lose what could have been truly great businesses.

Quick read: Selling Naked: A revolutionary approach to launching your brand